Price tag

Between 50 and 60 jobs will be axed at Shepway District Council. The redundancy forecast costs are £2.3 million according to SDC’s, Future Operating Model blueprint.How many golden goodbyes does that buy?

iGnite the Consultants brought into downsize the Council found cost savings of £6.6 million. This includes a £2 million investment in external IT procurement, £2.3 million of implementation costs, along with the 2.3m redundancy costs.

It means SDC will shrink from 269 Full Time Employees to 219 FTE. This, so the thinking goes, asks you to do more with less and SDC will transform itself into a leaner machine, more efficient and responsive to its customer base. (Seeing is believing) It is meant to eradicate what Roger Dean Duncan, a Business Consultant, calls “fake work”

However, in stark contrast to this, SDC is spending more than ever before on Temporary Staff Costs. These costs stand at £950,000 (Jan 18), the highest since SDC started publishing data in 2012. When compared against last year costs one can see a 15% increase and we are not at the end of the financial year yet. (See graph below) So as SDC reduces FTE’s, will Temporary Staff costs continue to rise as they have when compared to the last financial year? We will have to wait and see. And the £1 million barrier will be broken for the first time ever this financial year, just like SDC’s B&B costs.

What SDC see as savings of £6.6 million will not be fully realised until 2024/25, according to iGnite. And don’t you just love the graph below. Now that’s art, we believe. Creative, Imaginative…

At the same time they are cutting costs, SDC are also proposing to increase them. After the review of Car Park prices it is proposed that the free car parks at Stripes Club – Cheriton Rd, Folkestone , The Lade – Coast Drive, Lydd on Sea and Wilberforce Road, Sandgate, become fee paying cark parks. Cabinet will vote on the increases set out in Report C17-80 on the 28th February 2018. The report also sets out the recommendation to increase hotel guest permits by 50p to £2. The total additional income is forecast to be £147,516 and all recommended price increases can be seen here.

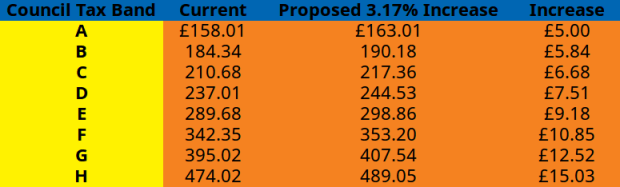

Just this week Kent County Council announced a 5% Council tax hike for all of us, and now SDC have to set their Council Tax rate. This will be done at Cabinet on the 28th Feb 2018 and they will vote on Report C-17-83 which recommends raising council tax to 3% (2.98), up 1% on last year. This report must also go before Full Council to be voted on, the same evening.

If Cllrs vote in line with the recommendations this means the amount SDC will retain of your Council Tax, currently £237.01 for a Band D, will rise by £7.51 to £244.53.

If you are having issues with Council Tax please do contact Shepway Citizen’s Advice Bureau.

In Appendix 3 of report C17/78, SDC’s own estimates of their external borrowing will increase from £65.9 million to £94 million by 2020/21 an increase of 42.6%. Of course this is inside the legal limits SDC can borrow, but in 2020/21, they will be just £2.4 million from the boundary of their maximum borrowing limits, according to their own estimates. Is this prudent?

As SDC’s debt is forecast to rise how can we truly be making any savings? Who will pay this debt down? The future generations Cllr Monk wants to buy into the Conservative dream of home ownership? Are the price increases on the Car Parks to help pay down the interest on the debt? Of course not, Oportunitas will come to the rescue, surely.

The future of Oportunitas Ltd will come before the Cabinet on the 28th Feb as well. The approved investment in the company for property acquisitions is now £4,787,500. It was formed in August 2014. It owns the following and is currently looking to add a further 4 units to its portfolio at a cost of £410,000

From the profit and loss account we can determine that presently Oportunitas Ltd covers their direct costs but do not generate sufficient surpluses to meet its overheads, according to Appendix 1 of report C-17-83. The report is about the future of Oportunitas Ltd which sets out three options, they being:

-

Do nothing – not recommended in report

-

Close Oportunitas Ltd – not recommended in the report

-

Refinancing & Scaling Up – recommended in the report.

If the Cabinet follow the recommendations and vote accordingly, avoiding any irrational behaviour, a cash injection by SDC of £6.9m will assist in Oportunitas Ltd becoming sustainable. This SDC say will provide:

-

“a modest but useful return to the General Fund of around £300k per year, or 2.6% on the capital employed.”

The cash injection of £6,9m by the council into Oportunitas will come from the Public Works Loan Board . It will be a 5 year loan at 1.5% pa.

By SDC’s calculation it will take 6 years before Oportunitas Ltd is trading profitably. And SDC does not rule out further cash injections into the company. So if the Cabinet vote this through, it will mean the Oportunitas Ltd has borrowed from its sole shareholder – SDC – almost £11.7 million.

The debt to equity ratio for the company will if voted on change from its current 90:10 split to 58:42 split.

Six years before Oportunitas Ltd sees as a profit, meaning no profit till 2022/2023 That means nine years worth of trading and nothing for the taxpayer. More cash injections are not ruled out and what we the taxpayer will get in return is a modest £300,000 pa. Is that Best Value for Money?

Now for those of you who can’t recall in Jan 2017 we wrote about SDC’s Debt in selling of the Family Silver

SDC’s debts at that time with the public loans works board were,

They had borrowed £40.1 million and will repay £17 million on top of the £40 million. The debts will not be cleared until 2030/31 as the graph below shows.

So the loan repyaments alone will begin to rise as of the next financial year. Add in the money they will borrow, so increasing their Debt levels even higher will mean the loan repyments will increase more than the graph shows.

This is proof, if proof be needed that Labour cannot be accused of a party of tax and spend. Our Local Conservatives are doing just the same, while the debt rises too. But hey don’t you worry about it, we’ll pass it onto the grandchildren. Responsible? What ever happened to living within your means?

Whatever your political persuasion; the cuts have long since arrived in Shepway. SDC is getting less money and has been getting less money for quite some time now. Whether you think that is right, we’ll leave you to ponder. The fact remains SDC has less cash to spend than they did, due to a national austerity programme driven by the incumbent governmen and by the choices SDC have made themselves. Something will give and more likely than not it will be your wallet or your purse that does the giving to pay down the £94 million, or 42.6% increase in SDC debt and those loan repayments.

The Shepwayvox Team

Incompetent, fiscally retarded idiots. Wake up Shepway electorate.

The Conservative dream is of indebtedness for life of the many to the few, home ownership being the key pillar to this.

There is just over a year to the next election… And then I hope the Tories will get a good kick in the ballots..

Why pay a private company to run parking enforcement, … Someone said Folkestone cricket club was going pay and display too .

A reduction of 50- 60- employees at a cost of £2.3m = an average of £46,000 to £38,000 each – way beyond what most would receive in the private sector. – I bet some fatcats will get more of this.

I would not put much faith in the SDC figures, the £46k may well includ all the extras like pension, HR admin lunch provision. Why do SDC trust the Consultant fantasists? Many years ago IT was outsoursed to a joint venture with Ashford, the £2M investment in IT has been paid once before at least and I suggest will just become a gravy train for someone. How many Tory Councillors have links to Managment Consultants or shares in outsoursing companies?